springfield mo sales and use tax rate

Department of economic security. 2022 Missouri state use tax.

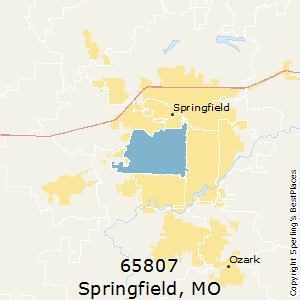

Best Places To Live In Springfield Zip 65807 Missouri

This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

. Depending on local municipalities the total tax rate can be as high as 101. The bandwidth of an amplifier is determined by. Missouri Department of Revenue 2018.

Mogov State of Missouri. 1 State Sales tax is 423. The MO use tax only applies to certain purchases.

052021 - 062021 - PDF. Mogov State of Missouri. Springfield Property Tax per 100 of assessed valuation.

Preston north end archives. Springfield MO Sales Tax Rate. Stanberry MO Sales Tax Rate.

4 rows How does the Springfield sales tax compare to the rest of MO. Raised from 6225 to 8725 Meadville Linneus Wheeling Sumner Purdin and Chula. Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address.

Stanton MO Sales Tax Rate. Spring Valley MO Sales Tax Rate. 17 rows Sales Tax City County and State taxes Knoxville TN.

Indicates required field. The Missouri MO state sales tax rate is currently 4225. Sales tax rate springfield mo.

Sales Tax and Use Tax Rate of Zip Code 65810 is located in Springfield City Greene County Missouri State. The capital of the world hemingway pdf. The base sales tax rate is 81.

The minimum combined 2022 sales tax rate for Springfield Missouri is. Estimated Combined Tax Rate 810 Estimated County Tax Rate 175 Estimated City Tax Rate 213 Estimated Special Tax Rate 000 and Vendor Discount 002. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

Spokane MO Sales Tax Rate. To obtain the sales tax rate information for a general area rather than a specific address you may. Springfields sales tax is 81 which includes the following breakdown.

For other states see our list of nationwide sales tax rate changes. 1 State Sales tax is 423. 042021 - 062021 - PDF.

Estimated Combined Tax Rate 598 Estimated County Tax Rate 175 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount 002. Sales Tax and Use Tax Rate of Zip Code 65804 is located in Springfield City Greene County Missouri State. What is the sales tax rate in the City of Springfield.

Missouri allows all state and local sales taxes to be remitted together at the state level. What is the sales tax rate in Springfield Missouri. Governor Michael L.

Pull back the curtain wizard of oz. Raised from 66 to 8725. If you have suggestions comments or questions about the Sales Tax Rate Information System please e-mail us at salesusedor.

Did South Dakota v. Squires MO Sales Tax Rate. Statewide salesuse tax rates for the period beginning July 2021.

Spickard MO Sales Tax Rate. Fifa 21 fifa points origin. This is the total of state county and city sales tax rates.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355. Higher sales tax than 62. Want to learn more about 647 Springfield Drive.

Sparta MO Sales Tax Rate. The County sales tax rate is. City of eden prairie public works.

4 rows Springfield MO Sales Tax Rate The current total local sales tax rate in Springfield MO. SalesUse Tax Rate Tables. E-mail us at salesusedormogov or.

Change Date Tax Jurisdiction Sales Tax Change Cities Affected. 072021 - 092021 - PDF. The Missouri sales tax rate is currently.

Jamaica property records. The Missouri use tax is a special excise tax assessed on property purchased for use in Missouri in a jurisdiction where a lower or no sales tax was collected on the purchase. Exact tax amount may vary for different items.

The Springfield sales tax rate is. Select a year for the tax rates you need. Statewide salesuse tax rates for the period beginning May 2021.

Recent Sales near 647 Springfield Dr. Statewide salesuse tax rates for the period beginning October 2021. Use the Sales and Use Tax Tables and Charts.

Call the Department at 573-751-2836. 647 Springfield Drive is currently listed for 339900 and was received on May 09 2022. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781.

The Missouri use tax should be paid for items bought tax-free over the internet. For a comparison of sales tax rates in other Missouri counties click here. 647 Springfield Drive Wentzville MO 63385 MLS 22028564 is a Single Family property with 3 bedrooms 2 full bathrooms and 1 partial bathroom.

Nyu steinhardt application deadline. Spring Bluff MO Sales Tax Rate.

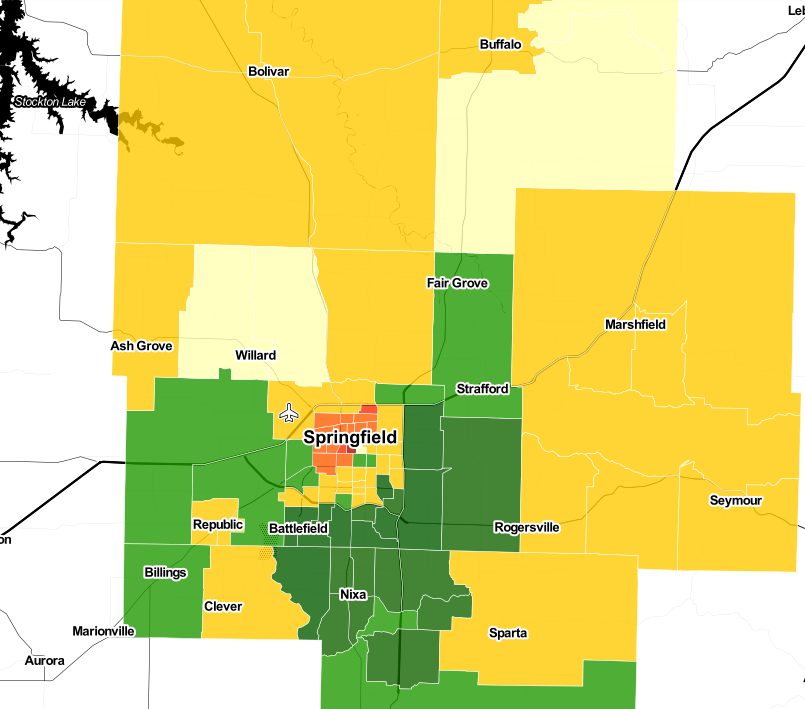

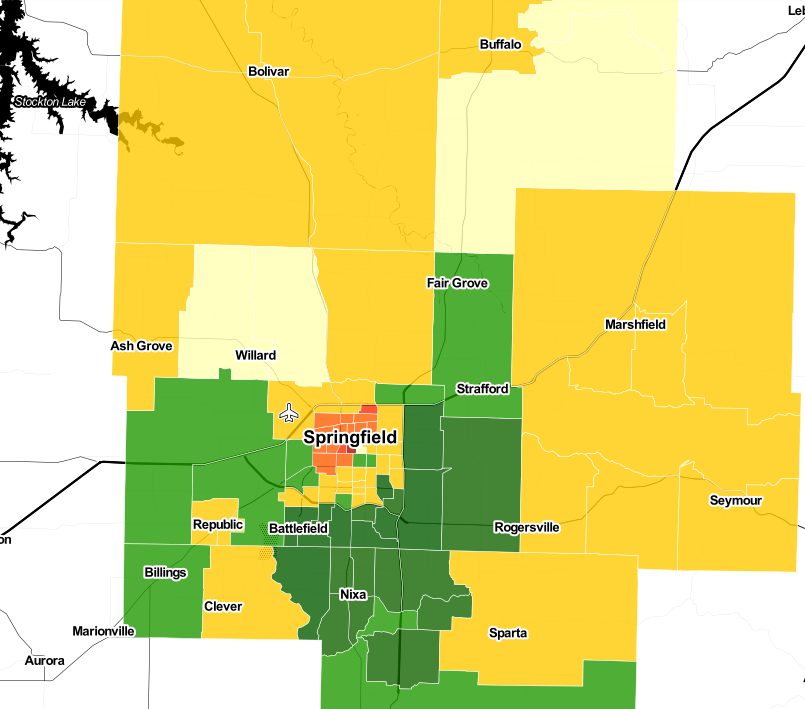

Springfield Mo Real Estate Market Stats Trends For 2022

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Best Places To Live In Springfield Missouri

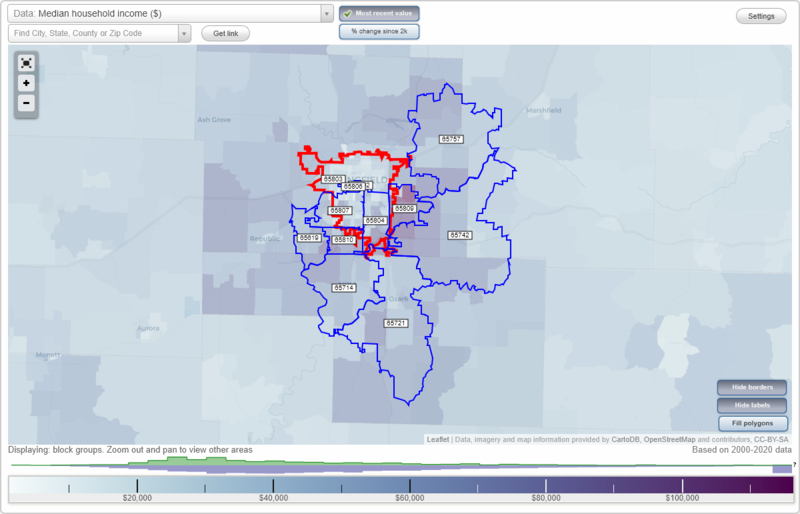

Springfield Missouri Mo Zip Code Map Locations Demographics List Of Zip Codes

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Best Places To Live In Springfield Missouri

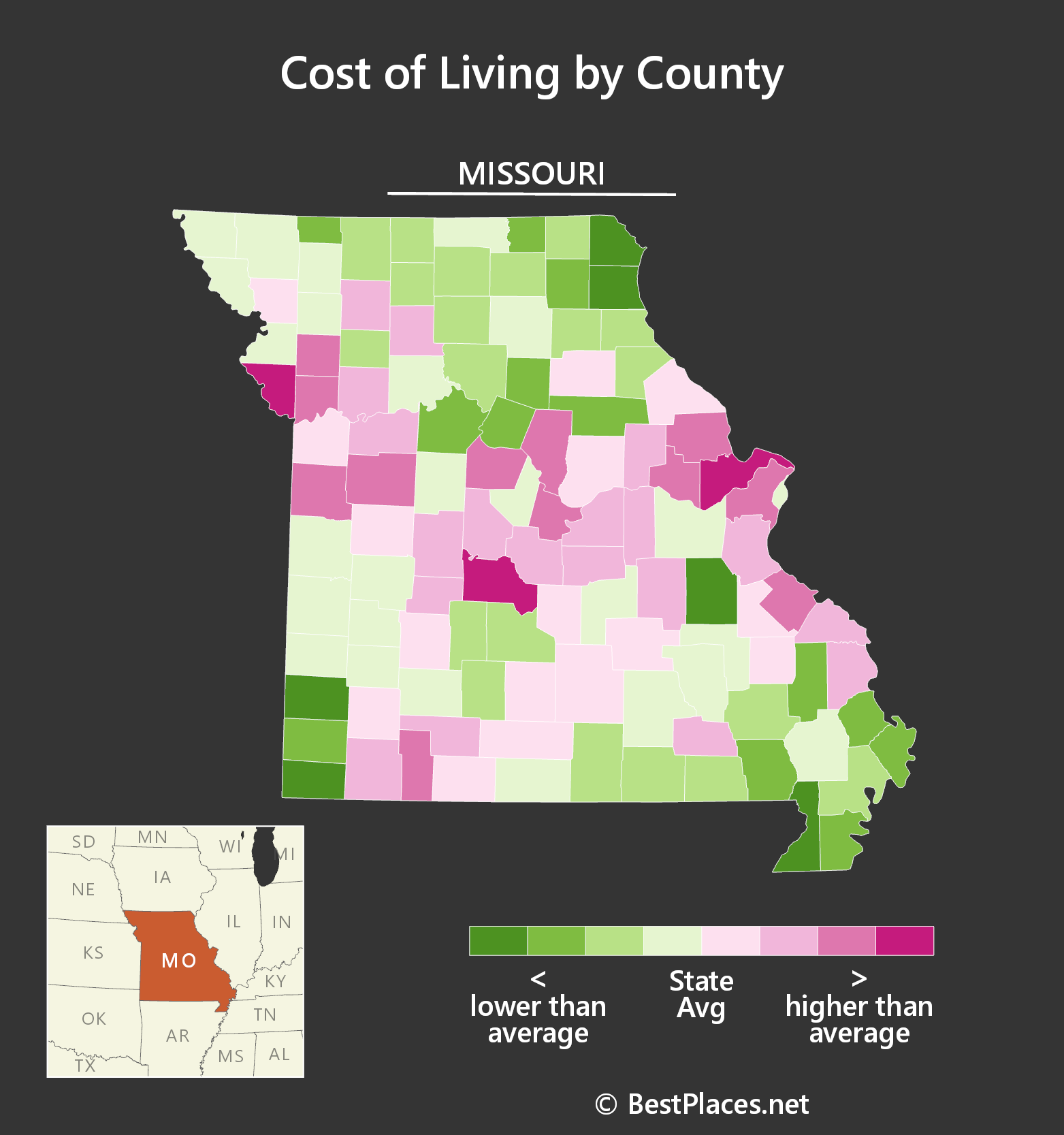

Taxes Springfield Regional Economic Partnership

Springfield Leaders Consider Expanding City Limits Kolr Ozarksfirst Com

Springfield Missouri S Hot Real Estate Market

The Top 10 List Of Best U S Cities For Retirement In 2014 Springfield Mo Tops Ceoworld Magazine

Taxes Springfield Regional Economic Partnership

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Springfield Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Best Places To Live In Springfield Zip 65806 Missouri

Costco Opens In Springfield Mo